2023 Benefit Highlights

2023 Open Enrollment closed on Friday, October 28, 2022 at 6:00 pm ET. If you didn’t make any changes to your benefits elections, your 2022 elections rolled over for 2023. If you currently have a flexible spending account and did not re-enroll, you will not have that benefit for 2023.

All health plan members will receive a new ID card. Remember, it is a combined medical and pharmacy card.

If you enrolled in the Copay health plan, you cannot participate in the health savings account and will not receive any funding. You may however, use any funds remaining in your HSA for qualified medical expenses.

If you enrolled a spouse in a Company Health Plan, they will be included in a spousal audit for other medical coverage. Please complete the spousal audit form as soon as you receive it. If your spouse’s employer offers insurance and you elect to cover him/her on a Mohawk Health Plan, you will pay an additional $125 per month in medical contributions.

If you are new to the Health Savings Account for 2023, you will receive a letter from HSA Bank. To ensure your correct funding, please provide HSA Bank the information requested in the letter to properly set up your account. If you do not provide the information, your account will automatically be closed by HSA Bank and you will not receive funding.

![]()

New for 2023

Health Plans

For 2023, the Choice Fund HSA plan premiums and deductibles will increase.

Great news, the Company's contributions to employee's health savings account (HSA) remains the same for all tiers!

The Copay plan rates and deductibles stay the same for 2023.

Employee Only out-of-pocket maximum will increase for the Choice Fund HSA plan and the Copay plan.

Dental and Vision

Dental and vision rates stay the same four years in a row!

Life Insurance

MetLife will be our life insurance partner, and we have an enhancement to this benefit. We are excited to provide all employees working 30 hours or more with a new $5,000 burial assistance benefit in addition to your Company-paid life insurance. Supplemental life insurance rates remain the same, and if you currently have supplemental life here at work it will automatically roll over to MetLife without having to take any action.

Long-term Disability

Long-term disability remains with OneAmerica but is moving to age-banded rates. Some groups will pay less while some groups may pay more. The advantage of having long-term disability insurance is that it is an in- come replacement. It can help you pay for your living expenses if an illness or injury keeps you out of work for 90 days or more.

|

Click the "Benefits 2023" menu at the top or above right for all 2023 plan details. |

![]()

Other 2023 Benefit Highlights

myCigna.com

Do you have your account set up at mycigna.com? If not, register today to access many resources available from Cigna as a Mohawk health plan member. Need a copy of our health plan ID card? Go to mycigna.com to print a copy or take a photo. You can also see a list of your claims and the status. Looking for an in-network provider? You can find a complete list at mycigna.com, as well as cost estimates for various procedures. Don’t forget that you can review your health savings account (HSA) information, including balance, contributions, and withdrawals.

Already have an account? Log in and see what is new!

Apps You Need

The myCigna app is an excellent on-the-go resource. Through the myCigna app, you have access to your health information. Get easy access for your ID card, claims, HSA account balance, provider search, and more. The Express Scripts app is like a pharmacy in your pocket. Manage your medication anytime, anywhere. With the MetLife app you can quickly find in-network dental and vision providers and file a claim. The Mohawk Benefits app connects you will all of our benefit partners with group numbers, phone numbers, websites and more. Get them now at the Apple App Store, Google Play Store, and Amazon App Store.

Your Healthy Life Care Teams

Our Healthy Life Centers continue to expand services to offer innovative ways to connect with all members of the Company health plan. We recently introduced Care Teams—each employee and their dependents have a special team of dedicated professionals ready to help you. Your Healthy Life Care Team may reach out to you and your dependents periodically throughout the year or you can reach out to them via![]()

Zip Code Search

Use the ZIP code search feature below to see which plan(s) you're eligible for in 2023.

2023 Medical Rates

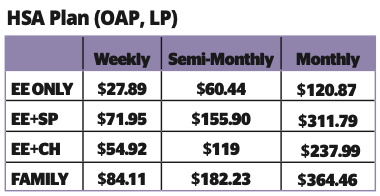

HSA NWGA, LP, OAP RATES

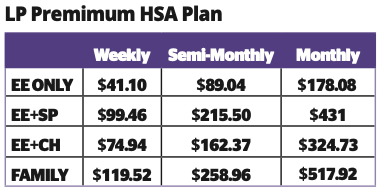

HSA LP PREMIUM RATES

COPAY RATES

For more details about all our medical plans, click on the Medical Menu under "Benefits 2023" above or on the right.

Medical Plan Surcharges

New enrollees to the company medical plan will be required to complete a biometric screening within 60 days of your benefit effective date to avoid a wellness surcharge. For additional details, visit the Biometrics and Health Coaching page.

Based on results, employees and/or covered spouses may be required to complete face-to-face, telephonic or online health coaching. Employees and covered spouses who choose not to work with a Healthy Life Team Navigator (HLN), do not make contact with their HLN or do not complete biometrics testing, will be charged an additional $28.85 per week or $125 per month as a surcharge on top of your medical plan premium.

If you enrolled a spouse in the Company Medical Plan, they will be included in a spousal audit for other medical coverage. If your spouse’s employer offers insurance and you elect to cover him/her on Mohawk’s Medical Plan, you will pay an additional $125 per month in medical contributions.

*New hires and those new to the medical plan as a result of a Qualifying Life Event, please visit the Biometrics and Health Coaching page for details.

![]()

Other Benefits Available to You

As a Mohawk employee, you are eligible for a slate of additional benefits and employee discounts that can help you save money. They include:

|

|

|

|||||

|

|

|

|||||

|

|

|

![]()

Questions?

If you have questions about your benefits, call the Benefits Service Center and speak with a Benefits Specialist at 1-866-481-4922.

- Monday - Thursday from 8 am - 6 pm ET, Friday from 8 am - 5 pm ET.