2024 OAP & Local Plus Copay Plans

2024 OAP & Local Plus Copay Plans

Cigna Local Plus Plan

The Local Plus Plan continues to be the medical plan for employees living in the following areas:

Arizona – Phoenix | California – Bay area and Los Angeles area | Colorado – Denver | Florida – Orlando, Tampa, South Florida (Miami metro area) | Illinois – Chicago | Kansas – Wichita | Massachusetts – Statewide | Nevada – Las Vegas | Rhode Island – Statewide | South Carolina – Greenville/Spartanburg | Texas – Austin, Dallas/Fort Worth, and Houston.

Open Access Plus (OAP) | CIGNA OAP

Employees living outside the northwest Georgia and Local Plus markets remain part of the Cigna Open Access Plus (OAP) plan. For employees in Local Plus markets, you may choose an OAP option at a higher premium. As always, we encourage you to confirm your doctor(s) are in the in-network for 2024. To find a in-network provider or hospital: use the Garner tool, visit mycigna.com or call Cigna at 855-566-4295.

When planning for your health care costs and Health Savings Account (HSA) contributions for 2024, remember in-network and out-of-network deductibles and out-of-pocket expenses are all separate and do not crossover. This plan does not apply to employees working in Hawaii; they remain on the HMSA plan.

Changes for 2024

Digital ID Cards

Cigna is moving health plan members to digital ID cards for health plans and pharmacy. You will not receive a new ID card in the mail. You can download and print one from mycigna.com or request one be sent to you via mycigna.com or by calling Cigna Customer Services at 855-566-4295.

Garner

Looking for the best doctors to help you get the best patient outcomes? Garner can help! Garner is an innovative new benefit available to all Mohawk health plan members. With this data-driven doctor search tool, you can easily find the top 20% of all doctors who get better outcomes with fewer complications. Plus, Garner’s user-friendly platform lets you get personalized recommendations for in-network doctors and facilities based on your needs.

And if you need more help or information, Garner’s concierge service is available via chat or email. So why wait? Download the Garner Health app or visit getgarner.com to get started today! Then, use the Garner Health app or website to search for doctors nearby who are in-network and have availability to see you.

Specialist Visit Copay

A specialist visit for the Copay Plan increases to $50.

Rates and Deductibles

Rates and deductibles have changed. Please review the chart under "Rates" below.

Pharmacy

Brand-name diabetic medications will have a $50 copay, excluding test strips, while the generic versions are available at no cost. You’ll generally pay less for generics than for brand name drugs. Talk with your doctor about whether there’s a lower cost option for your medication.

Pharmacy is included when you elect medical coverage. Express Scripts remains our pharmacy vendor. The formulary with Express Scripts can change yearly. To avoid paying full price, please review the 2024 Preferred Formulary and Formulary Exclusion List.

Limber Health

With Limber, you can do physical therapy from the convenience of your home. You’ll get a customized care plan that can help relieve pain or discomfort in your low back, shoulders, neck, hips or knees. The program includes a clinical team of physical therapy experts and educational resources to help support you. Plus, it is available at no cost to you. To see if you qualify, scan the QR code or text or call 240-269-6066.

Benefits to Help You Save Money and Time

Our Healthy Life Centers continue to expand services to offer innovative ways to connect with all members of the Company health plan. We recently introduced Care Teams—each employee and their dependents have a special team of dedicated professionals ready to help you. Your Healthy Life Care Team may reach out to you and your dependents periodically throughout the year or you can reach out to them via

Preventive Care and Other Ways to Save

We believe prevention plays a vital role in health care. To catch problems early, we encourage you to get preventive screenings and annual checkups. Don’t forget—your in-network preventive care is 100% covered! It’s never too late to start your journey to become a healthier you. Your good health is important–to you and your family.

By using in-network providers, our onsite clinics and Amwell telehealth for acute care, mail-order prescription services, participating in pilot programs and limiting visits to the emergency room to true emergencies, you can be a savvy shopper for both quality care and lower cost. Make the most of your coverage and savings opportunities.

Amwell

Looking for a fast, easy, and convenient way to see a doctor? Amwell telehealth is here to help! With live video visits available from your computer, tablet, or mobile device, you can connect with a board-certified doctor at a time that works for you 24/7/365. This is the perfect solution when your doctor’s office is closed, you’re too sick to leave home, too busy to see someone in person, or even as a great alternative to a late-night ER visit.

It’s free to enroll, and the cost per visit is just $20 for acute care visits for health plan members and $69 for Mohawk employees not on the health plan. So why wait? Sign up today @ Mohawk.amwell.com or download the app.

Zip Code Search

Zip Code Search

Use the ZIP code search feature below to see which plan(s) you're eligible for in 2024.

Plan Overview

- NO REFERRALS - Choose the doctors you want to see – no referral required to see a specialist.

- COPAY - $35 Primary care, $50 Specialist, $25 Urgent Care visit, pharmacy-refer to pharmacy chart

- DEDUCTIBLE -With the Copay plan, you pay 100% of your health care expenses until you meet your annual deductible, excluding office visits. See deductible amounts below.

- COST SHARING - After meeting your annual deductible, you share the cost of health care expenses by paying co-insurance (a percentage of the total cost).

- PREVENTIVE CARE - In-network routine preventive care and qualifying preventive prescriptions are covered at 100%.

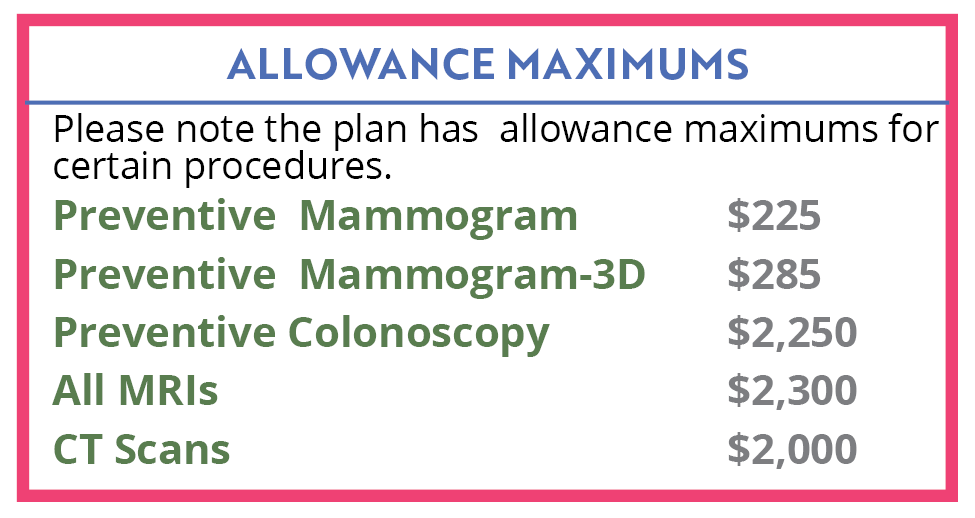

- ALLOWANCE MAXIMUMS - Note that there are allowance maximums for preventive mammogram ($225), preventive mammogram-3D ($285), preventive colonoscopies ($2,250), all MRIs ($2,300 after deductible is met), and CT Scans ($2,000 after deductible is met). See details.

- OUT-OF-POCKET MAXIMUM ALLOWANCE - The most a plan member will pay per year for covered health expenses before the plan pays 100% of covered health expenses for the rest of that year.

> In-Network - Employee Only - $6,000; Family - $13,000

>Out of Network - Employee Only - none; Family - none - PRESCRIPTION - Qualifying Walmart prescriptions $4 List or $0 for certain generics, copay applies (see Pharmacy chart)

- MEDICARE - If you are covered under Medicare, you are eligible to participate in the Company Medical Plan, however, you are not eligible to own an HSA Account per IRS guidelines.

- HSA ELIGIBILITY - Per IRS rules, you may not enroll in or add funds to a HSA if not enrolled in a high deductible health plan.

- FSA ELIGIBILITY - You may participate in the healthcare FSA account if you enroll in the Copay Plan, age 65 and older and not enrolled in a high deductible health plan.

![]()

Medical Plan Details

Click on the plan(s) below that applies to you for details.

|

|

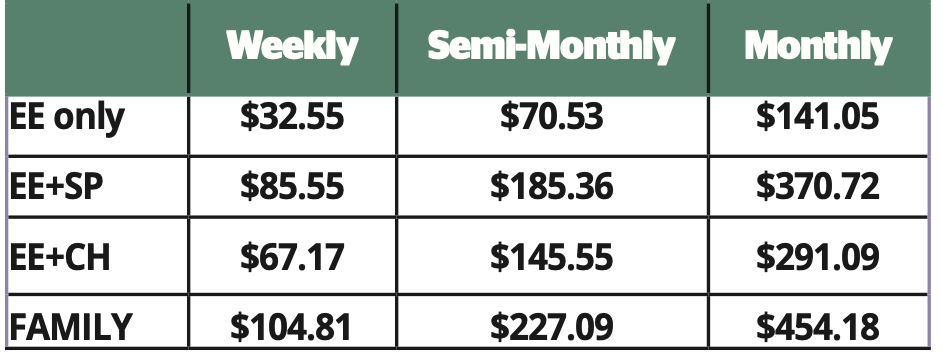

Plan Rates

*For coverage, Spouse also refers to Common Law

![]() Premium Assistance Under Medicaid and the Children’s Health Insurance Program (CHIP)

Premium Assistance Under Medicaid and the Children’s Health Insurance Program (CHIP)

Copay Plan Deductibles

Employee Only: In-network:$1,100 | Out-of-Network:$3,300

Employee + Spouse; Employee + Child; Family: In-Network: $2,750 | Out-of-Network: $6,600

Co-Insurance | In-network: 80% After Deductible | Out-of-Network: 50% After Deductible

Out-of-Pocket Maximum | In-network: Employee only $6,000 | Family $13,000 | Out-of-network—Employee Only and Family: None

Medical Plan Surcharges

New enrollees to the company medical plan will be required to complete a biometric screening within 60 days of your benefit effective date to avoid a wellness surcharge. For additional details, visit the Biometrics and Health Coaching page.

Based on results, employees and/or covered spouses may be required to complete face-to-face, telephonic or online health coaching. Employees and covered spouses who choose not to work with a Healthy Life Team Navigator (HLN), do not make contact with their HLN or do not complete biometrics testing, will be charged an additional $28.85 per week or $125 per month as a surcharge on top of your medical plan premium.

If you enroll a spouse in the Company Medical Plan, they will be included in a spousal audit for other medical coverage. If your spouse’s employer offers insurance and you elect to cover him/her on Mohawk’s Medical Plan, you will pay an additional $125 per month in medical contributions.

*New hires and those new to the medical plan as a result of a Qualifying Life Event, please visit the Biometrics & Coaching page for details.

Surcharges:

The information below outlines ways in which medical surcharges will be applied. Keep in mind, the maximum surcharge is $57.70 per week or $250 per month in addition to your Medical plan contribution.

- $28.85/wk or $125/mo: If covered Employee does not complete a Biometric Screening when notified.

- $28.85/wk or $125/mo: If covered Spouse* does not complete a Biometric Screening when notified.

- $28.85/wk or $125/mo: If covered Employee requires Coaching based on biometric screening results and refuses to work with a health coach.

- $28.85/wk or $125/mo: If covered Spouse* requires Coaching based on biometric screening results and refuses to work with a health coach.

- $28.85/wk or $125/mo: If Spouse* enrolls in the Mohawk Medical plan and has access to other group medical coverage through their employer.

Healthcare Flexible Spending Account (FSA) Option

Employees enrolled in the Copay Plan and employees age 65 and older may participate in the healthcare Flexible Spending Account (FSA) which acts much like the Health Savings Account (HSA). You set aside money from your paycheck to pay for qualified out-of-pocket expenses for you and your covered dependents. And, you don’t pay taxes on this money. With an FSA, you decide how much you want to contribute each year, up to the legal limits. The money in your Healthcare FSA can be used to cover out-of-pocket costs, such as copays, deductibles, coinsurance, dental expenses, prescription glasses, contact lenses, prescription drug costs and over-the-counter drugs with a prescription.

For more information about the healthcare Flexible Spending Account (FSA), click here.

![]()

Additional Links and Information

![]() Local Plus Copay Plan Summary Plan Description

Local Plus Copay Plan Summary Plan Description

![]() OAP Copay Plan Summary Plan Description

OAP Copay Plan Summary Plan Description

![]()

![]() Summary of Material Modification-VIVIO Specialty Medications Program

Summary of Material Modification-VIVIO Specialty Medications Program

![]() Approved Cigna Flu Shot Providers

Approved Cigna Flu Shot Providers

![]() Preventive Health Coverage Guide

Preventive Health Coverage Guide

![]() Eligible and Ineligible Expenses

Eligible and Ineligible Expenses

Contact the Benefits Service Center or CIGNA

For questions about your benefits including claims, eligibility, or to order an ID card contact

Benefits Service Center | 1-866-481-4922 OR

Cigna | 1-855-566-4295 | www.mycigna.com

Important Notes:

- In Ala., Calif., and N.J., contributions are prior to federal taxes but after state income taxes. Employer contribution, earned interest and investment income are all taxable as gross income for state income tax purposes.